Credit Report: Have You Done Your Annual Checkup?

Reviewing your credit report as part of your financial routine is like doing an annual physical with your doctor each year by catching problems early.

Reviewing your credit report as part of your financial routine is like doing an annual physical with your doctor each year by catching problems early.

Even if you do not plan on seeking out new credit, check your report once a year for accuracy and detecting errors, suspicious activity, and accounts or address you don’t recognize to protect your financial health.

Inaccurate information on your credit report can happen for various reasons. When reviewing each agency report, ensure the following information is correct:

- Your name, addresses, and identification numbers

- The type of accounts that show as yours

- Recognize hard inquiries are familiar

- Public record or collections

Any information that is not yours, may be possible identity theft. If you see anything that does not look right or you do not remember, contact each of the credit agencies (Experian, Equifax, and TransUnion). You have the legal right to correct information on your credit report and the credit agencies must investigate and correct the mistakes.

You are entitled to a free report from each of the three major credit agencies (Experian, Equifax, and TransUnion) every 12 months. To correct errors on your report, send a written dispute to each credit agency that has reported incorrect information. Periodically check to make sure that the incorrect information is deleted permanently.

To reduce the likelihood of someone using your personal information and credit to open financial accounts, keep your personal information and credit score safe and private.

- Never give personal information over the phone, text, email, or in-person unless you are certain it is a trusted source.

- Government agencies never call to request personal or financial information and all official government business is mailed.

- Institutions of higher education or financial aid will also provide written documentation.

- Trustworthy institutions will always mail information to your address on file.

Credit Terminology:

Credit Report: Information compiled by a credit agency from merchants, utility companies, banks, court records, and creditors about your payment history.

Credit Agency: A firm that collects and keeps records of borrowers’ credit histories.

Credit History: A continuing record of a person’s credit usage and repayment of debts.

Identity Theft: Someone uses your personal information without your permission.

AnnualCreditReport.com: The only source for your free credit report. https://annualcreditreport.com

Credit Freeze: Prevents potential creditors from accessing your credit file. This prevents you or others from opening accounts in your name.

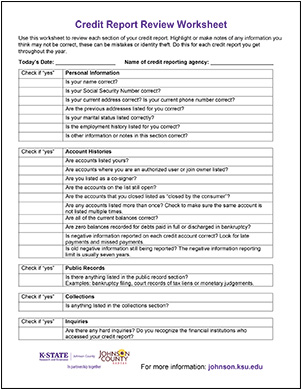

Credit Report Review Worksheet

Once you get your credit report, you will want to review it carefully. Ordering it is not enough--you have to read it. Credit reports may have errors. If there are errors, you are the only one who is likely to find them.

More Resources:

- Request Your Credit Report (PDF)

- Understanding Your Credit Report (PDF)

- Fixing Credit Report Errors (PDF)

- Building and Maintaining Credit (PDF)

Federal Trade Commission Consumer Advice:

Free Credit Reports | Consumer Advice (ftc.gov)

Contact Us