Keep Your Resolution to Improve Your Credit

Return to Home and Family Agent Articles

A good credit score can help you to purchase big-ticket items like a car or home, but is it important to check it often? The answer is yes. Your credit report shows your credit history. This is what lenders use to determine your creditworthiness in loaning money.

It is recommended that everyone should check their credit reports with each of the three credit bureaus once a year. The credit bureaus are Experian, TransUnion, and Equifax. Everyone is entitled to one free credit report a year. Do you remember the last time you ordered one? If it has been over a year, then here are a few reasons why you need to check it out.

If you were denied credit for a loan or credit card, you can receive a free copy of your credit report. Be sure you order it within 60 days of the denial of credit in order to get it for free. Reviewing your report can alert you to any misinformation in the report or problems that you need to address to improve your credit score.

Are you getting ready to apply for a loan? If so, request a copy of your report before you apply, so that you will be familiar with the information in it. Do this before you meet with your lender. Just know that every time a lender requests a credit report for you it will lower your credit score. Be careful in allowing lenders to pull your credit report, especially if you are not able to qualify for credit. This results in an unnecessary inquiry and can hurt your credit score. Some typical things that can prohibit you from getting credit are accounts that are in a collection, late payments, high credit balances, and a low credit score. If your credit is less than stellar, pay off past due accounts, dispute any errors on your report and reduce your credit card balances. Once your credit report shows that you have made these improvements, then apply for a loan.

Identity theft is a real and present danger. With so many data breaches and personal information that can easily be accessed, everyone needs to be diligent about checking their credit reports regularly. You can take steps to safeguard your information, but if you are victimized you can expect to spend months repairing the damage. This is one good reason to sign up with a company that can monitor your credit and alert you if there is any suspicious activity.

If you have cosigned a loan for a family member or friend, you need to monitor if they are making on-time payments. If they make late payments, it will show up on your credit report. By checking on it frequently, it allows you a chance to make financial arrangements with the creditor before serious credit score damage can occur.

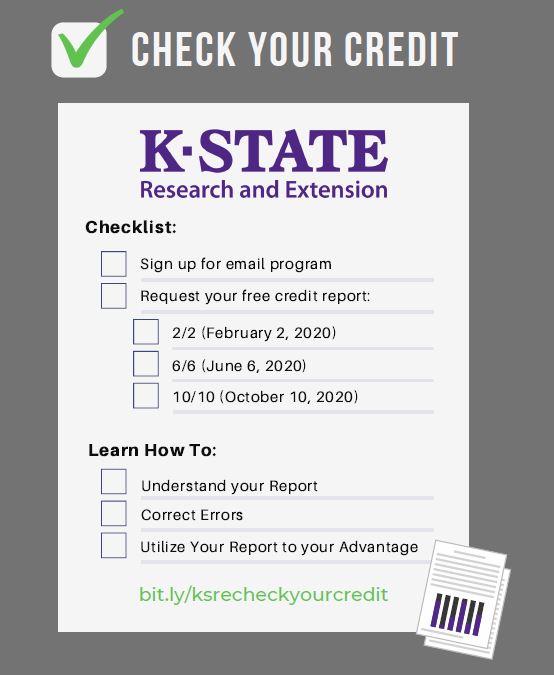

To help you remember to check your credit score we are rolling out a new statewide program. It is an email reminder program that you sign up for to receive notices during the year to check your credit. The notices will go out on 2/2, 6/6 and 10/10. Along with the notes, you will receive three brief articles explaining how to read and understand your credit report, correct errors and use it to your financial advantage.

The program is free to participate in. Sign up today at www.bit.ly/ksrecheckyourcredit