Medicare Changes for 2023

by Joy Miller | Family & Community Wellness Agent

Medicare isn’t a single policy. Instead, insurance through Medicare and private insurers can have several different types of coverage. These are designated by letters, which can be confusing for even the savviest retirees.

To help sift through the alphabet soup of Medicare, here is a breakdown of what those letters mean and some of the changes happening in 2023.

Part A (Hospital Insurance)

Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. The Medicare Part A premium is zero cost for most beneficiaries based on work history or a spouse’s work history.

Part A has a deductible that applies to each benefit period and generally increases each year. It will be $1600 in 2023, up from $1556 in 2022. The hospitalization coinsurance will also increase to $400 for days 61-90 of the hospitalization; $800 for lifetime reserve days; and $200 for days 21-100 of extended care services in a skilled nursing facility.

Part B (Medical Insurance)

Helps cover services from doctors and other healthcare providers, outpatient care, home health care, durable medical equipment, lab services, and many preventive services. The standard Part B monthly premium was $170.10, and in 2022, the amount decreased to $164.90. The annual Part B deductible in 2022 was $233, and in 2023, the amount decreased to $226.

A contributing factor for the 2022 Medicare Part B premium and deductible increase was due to the introduction of Aduhelm, a drug approved by the FDA to treat Alzheimer’s decrease. The 2022 rate was implemented to help defray the anticipated cost of Medicare coverage. The predicted demand for this drug was lower than expected, the manufacturer announced it was cutting the price. This resulted in larger reserves in the Supplementary Medical Insurance Trust Fund, which is used to limit future premium increases. Because of the lower cost of the Alzheimer’s drug, premiums and deductible was lowered for 2023.

Part D (Drug Insurance)

Helps cover prescription medications. These plans are sold by private insurance companies as stand alone plans or bundled with Advantage Plans, also known as Part C. The annual deductible increased to $505 in 2023, up from $480 in 2022. Not every drug plan will have a deductible or may have a lower deductible. Monthly premiums vary from $2.80 to $112.60.

The 2022 Inflation Reduction Act will reduce some Part D costs in 2023.

Beginning January 1, 2023 insulin included on a Part D plan formulary will have a $35 monthly co-pay and will not be subject to the deductible. It will also stay consistent throughout the Initial Coverage Phase, Coverage Gap (Donut Hole), and will not exceed the $35 co-pay in the Catastrophic Coverage phase (the cost of insulin will be $35 or less). Insulin prices may be less than $35 depending on the plan. This does not include all injectable medications used to control diabetes such as Victoza, Trulicity, Ozempic, Jardiance, or Farxiga. If you do your own drug plan comparison, the medicare.gov plan finder will not reflect this pricing throughout 2023.

For those whose insulin is covered under Medicare Part B durable medical equipment, such as insulin pumps, will also have a monthly co-pay of no more than $35 beginning July 1, 2023.

Medicare beneficiaries will have no cost sharing for vaccines that are recommended by the Advisory Committee on Immunization Practices, such as Shingles and Pneumonia vaccines.

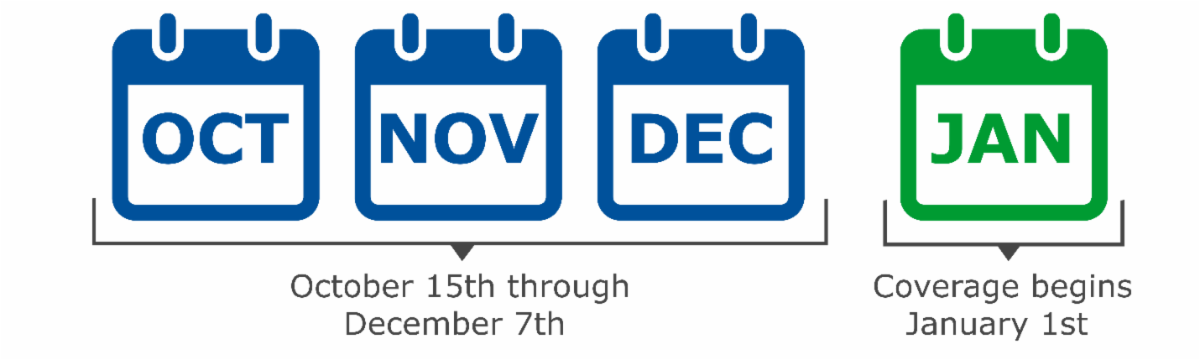

Open Enrollment is from October 15-December 7. It is time to explore your Medicare coverage options and decide if you want to join, switch, or drop health or drug plan. If you would like assistance, we are here to help. Senior Health Insurance Counseling for Kansans (SHICK) is a free, impartial service to help beneficiaries make informed decisions and get the most value for their Medicare health insurance dollar. For a one-to-one counseling appointment or general questions, contact Joy Miller, Family and Community Wellness Agent, at 913-715-7000.